Digital transformation in banking refers to the integration of digital technologies into all components of banking functions and expert services. This transformation spans inside processes, shopper interactions, and back-Office environment functions, reshaping how banking companies produce price and communicate with clients within a digital-very first environment.

Suitable qualifications for employees usually are not adequately offered, and this seems being a disadvantage for that implementation of advanced digital topics and the general digital improve in banks. Skills will have to be tailored Sooner or later.

Financial institutions also are introducing digital wallets and virtual playing cards to compete with fintech answers, improving benefit and stability.

Keep in mind the last time you stood in line on the financial institution, impatiently shuffling forward with a stack of paperwork? People days are swiftly fading due to the interesting wave of digital transformation in banking. This revolution is reshaping how we regulate our finances, giving a planet of comfort, protection, and personalization at our fingertips.

AI can substantially enhance possibility management in banking by automating fraud detection, checking transactions in real time, and pinpointing potential stability threats.

In pinpointing the kappa coefficient, “P observed” represents The easy share of settlement. The calculation of “P prospect”, the random match, relies around the calculation by Brennan and Prediger [89], who have intensively researched the optimal application of Cohen’s kappa and its problems with unequal marginal sum distributions. Employing this calculation process, the random match is decided by the quantity of diverse categories used by both coders.

Edstellar can be a a single-end instructor-led company training and coaching Answer that addresses organizational upskilling and expertise transformation needs globally.

This change from handbook processes to automatic workflows streamlines operations and guarantees faster, more exact expert services for patrons.

A larger sample typically leads to additional confident plus more reliable statements on what to search for [69]. The size in the samples for qualitative analyses is normally smaller than for quantitative analyses. Regularly, a lot more correct and even more representative inferences about the populace can be built in the case of large sample proportions; however, interviews will only be completed as long as new information is perceived. In theory, the sample sizes ought to be large more than enough to get sufficient details to adequately digital transformation in banking explain a phenomenon of desire also to empower the exploration concerns to become answered.

In reality around forty three% of shoppers will abandon a sign-up process for explanations like: it will take as well long, it’s bewildering, or I’m requested for an excessive amount of data.

The phrase digital transformation (in some cases nicknamed digital entrepreneurship) is often misunderstood as a straightforward deployment of the most up-to-date details and conversation systems. In exercise, technological investments entail don't just possibility, but will also need an knowledge of the relationship concerning technological and organisational culture and institutional alter within just selected boundaries of regulatory frameworks.

The guideline study focused on interviews with final decision-makers at banks. These ended up recognized via personalized contacts from the economical and banking sector and active ways towards banking associations and local banking institutions, as This is when obtain digital transformation in banking complications appear to be the bottom [70].

Digital transformation presents fascinating chances for financial institutions, but it is not without its hurdles. This is a evaluate a lot of the critical issues banking institutions encounter and potential solutions to beat them:

Individualized Financial Services: Applying facts analytics, banking companies present customized monetary information and solutions tailor-made to individual purchaser requires, boosting The shopper encounter.

Brandy Then & Now!

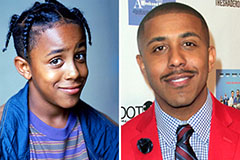

Brandy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!